#DreamSpeakers’ advice for youth on navigating personal finance

Summer has arrived and with it many practical life lessons! Financial literacy is an important skill that is sometimes left out of classroom curriculum, but it was this week’s focus for one Youth Organization United to Rise (YOUR) Community Center program. Petals of Primrose is a Washington, DC-based leadership program for adolescent girls dedicated to helping young women make better and informed decisions through exposure, awareness, and leadership opportunities. With the help of YOUR’s Casey Pegram, 13 young women spoke with inspirational female mentors about the importance of financial literacy.

Over the course of a week, three outstanding #DreamSpeakers came together to share about their careers in finance. To kick it off, Petals of Primrose participants spoke with Ruth Ward, an Assurance Manager at PricewaterhouseCoopers (PwC). In her role, Ms. Ward helps companies and their employees to understand how accounting impacts their business. Next, the young leaders were joined by Jennifer Soong, a Finance Manager at Twitter. Her work centers around assessing and closing beneficial deals for Twitter. We wrapped up the week hearing from Pia Mishra, a Growth Investor at CapitalG who is always on the hunt for companies that show signs of above-average growth in which she can invest. Each of these incredible speakers shared their advice on personal finance, budgeting, and the importance of getting started on your finance journey early. Check out their advice below!

Personal Finance

We each have a unique relationship with personal finance, which our #DreamSpeakers illuminate through their guidance. For Ms. Ward, personal finance is all about taking care of your future self. As she puts it:

When thinking about how to save, Ms. Ward recommends remembering the distinction between living expenses and lifestyle expenses. Determining your needs versus your wants is key in developing a financial plan that takes care of your future self.

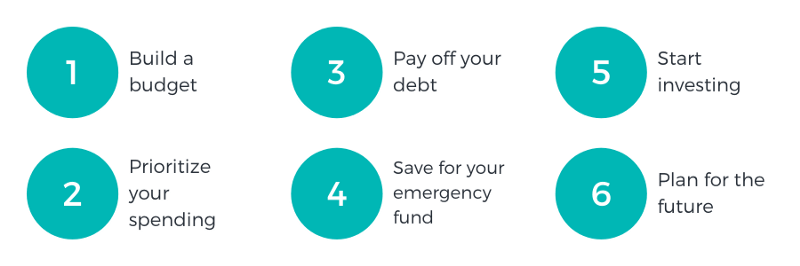

Personal finance has a steep learning curve, though. Ms. Soong is a first-generation college graduate with parents who immigrated to the United States. For her, personal finance is about creating generational wealth to take care of her future self and family. She recommended six tips on how to develop a personal finance plan.

Ms. Mishra’s advice on personal finance centered on the small things we can do to help our future self. She recommended using money management apps to keep yourself accountable for your financial goals and also suggested using mobile apps to manage your credit score or navigate budgeting.

Budgeting

Each #DreamSpeaker underscored the importance of creating budgets as a way to develop a financial plan. Students were eager to learn, how can I start or maintain a budget? Ms. Ward suggested changing our mindset around budgeting. Instead of thinking about budgeting as a savings plan, she suggested approaching it as a spending plan; this helps eliminate the perspective that personal finance has to be restrictive, and you still get the desired effect of creating a saving habit.

Ms. Mishra is all about flexibility. She suggests:

She encouraged the girls to recognize the unpredictable nature of life. Life events and/or purchases that were not originally planned in a budget will inevitably arise. The key to bounce back from these events is to be ready to pivot, which requires a mindset that is willing to change as life does.

Ms. Soong’s budgeting tip is to focus on two factors: how much money is coming in and how much money are you spending. She encourages asking yourself these questions to begin an honest conversation with yourself about personal finances.

The Earlier, The Better

The #DreamSpeakers were united in their perspective that the earlier you begin to think about personal finances, the better. Personal finance is a lifelong journey, so learning techniques and skills to manage finances at a young age is critical to taking care of your future self. As Ms. Mishra said, “Thinking about your personal finances in the same way you think of your physical health could be the key to maintaining helpful finance practices. Just as we have habits to keep our hygiene intact, think of different habits to form to keep our personal finances intact.”

Written by La’Treil Allen and Summer Nguyen, DreamWakers Education Interns

Thank you to our wonderful #DreamSpeakers for their great advice and the young women of Petals of Primrose for their enthusiastic engagement.

Want to learn more about more personal finance apps? Check out a list here! Have any resources for personal finance to share with the DreamWakers community? Visit us on Facebook, Twitter, and Instagram to share!